How can a business grow externally or inorganically?

External (inorganic) growth

As well as growing internally (also known as organically), businesses can grow externally (also called ‘inorganically’). This means that they join with another business.

External growth could be through

franchising

a merger

a takeover

Franchise

What is a franchise? revision-guideWhat is a franchise?

Click on the link to find out about the key points about what a franchise is.

What is a merger?

A merger occurs when two businesses agree to join together, to form a new (but larger) business.

An example of a merger

Business ‘A’ and business ‘B’ each want to expand but do not feel they can get any bigger alone. The two businesses decide to come together and share their locations, stock, marketing, products and staff. This allows them to grow together as a single business.

Takeovers

A takeover occurs when an existing business expands by buying more than half the shares of another business.

An example of a takeover

Business ‘A’ decides it wants to grow but the area it wants to grow into is already occupied by a similar or smaller business; called business ‘B’. Business ‘A’ decides to buy over 50% of the shares in business ‘B’ in order to take control. This gives business ‘A’ access to growth through ownership of a new business in either the same or a different area of the market.

The five merger and takeover methods

When two firms come together either through a merger or takeover, it is sometimes referred to as integration (two things becoming one). There are five methods through which a business can merge with or take over another business.

Image caption, Horizontal integration occurs when two competitors join through a merger or takeover. The new business then becomes more competitive and increases its market share. This gives it more control when negotiating and setting prices.

Image caption, Forward vertical integration occurs when a business takes control with another that operates at a later stage in the supply chain.

Image caption, Backward vertical integration occurs when a business takes control of a business earlier in the supply chain.

Image caption, Conglomerate integration occurs when businesses in unrelated markets join through a takeover or merger. This enables businesses to spread their risk over a wider range of products and services.

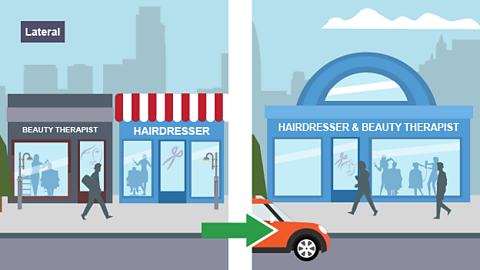

Image caption, Lateral intergration occurs when two businesses which are similar but not the same merger together in related markets.

1 of 5

Try the integration quiz

Evaluation of methods of growth

Inorganic growth

Advantage

Retain control of the business.

Disadvantage

Slow

External growth (all kinds)

Advantage

Fast!

Disadvantage

Possible loss of control as other business owners/managers now involved in your affairs.

Franchising

Advantage

- instant brand reputation and customers

- low risk of failure

Disadvantage

high fees/royalties

very little control over decisions

Takeover

Advantage

Fast way to acquire new business premises, machinery, stock and access to new customers.

Disadvantage

May be resentment / fear from the target company staff.

Merger

Advantage

economies of scale

access to new customers

Disadvantage

clash of business cultures

staff may be made redundant, affecting morale

Horizontal integration

Advantage

Elimination of a competitor!

Disadvantage

you might have bought a firm with some problems (e.g. hidden debts)

may draw the attention of the Competition and Marketing Authority (CMA) if market share exceeds 25%

Backward vertical integration

Advantage

Secure supply of raw materials.

Disadvantage

Is this an area of expertise?

Forward vertical integration

Advantage

Secure outlet for products (eg shops).

Disadvantage

Is this an area of expertise?

Lateral integration

Advantage

spreads risk (not exactly the same products) whilst allowing for economies of scale

similar skill sets of both sets of staff

Disadvantage

Not an exact understanding of the market (customers).

Conglomerate (diversification)

Advantage

Spreads risk: falling sales for one product can be offset by rising sales of a different product.

Disadvantage

potential confusion for customers: why is a car manufacturer selling backpacks?

potential for lack of co-ordination between different departments/ divisions

Try the external business growth quiz

Final checks

What is the main difference between a merger and a takeover?

A merger occurs when two businesses agree to join together to form a new, larger business, sharing resources and operations.

In contrast, a takeover happens when one business expands by purchasing more than half of the shares of another business, gaining control over it.